An estimated 5.5.m Brits are now expats abroad, which equates to approximately 1 in 10 of the UK population. Whether heading out to retire or to work, becoming a citizen of another country has some specific challenges. Arranging such a move brings with it many things to consider and it can be a stressful time for the individual who wants to make a major life change. There are the obvious tasks that must be completed before the move. Finding a new country is the first challenge, then finding that perfect place to call home. Getting financials right is also a vital component of moving abroad and starting a new life. However, one question to consider is your life insurance, does your UK policy cover you in other countries?

With so much going on, you may not have even considered life insurance. Research has shown three quarters of the UK population have no life insurance, but there will be a time when you do need to arrange some. The best time to do this may be before your head out and officially become an expat. If you have a UK life insurance policy, it’s important to know if you are covered in the top expat locations.

Before considering investing in international life insurance for expats, it is essential to have a number of questions that you want answering before you commit yourself. This article will aim to answer some of the most common questions about life insurance for expats.

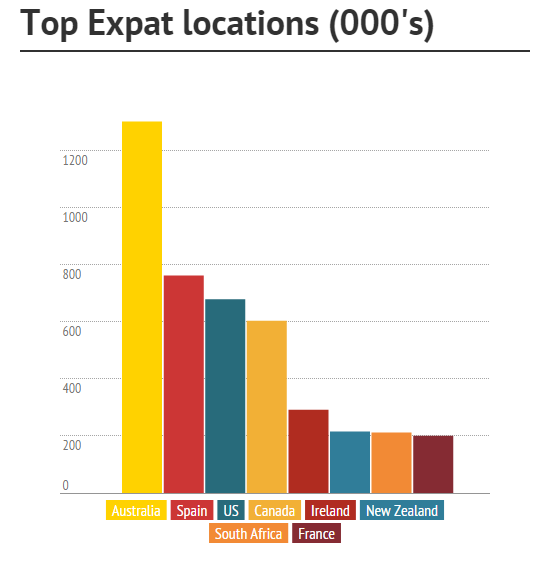

Top Expat locations

Data source

If you are heading to one of the top expat locations above, its important to contact your policy provider and ask if you are covered for death in this country. Policies will vary but they will advise you accordingly.

Life Insurance for Expats: Do I need it?

The truth is, not everyone needs life insurance. Those planning on travelling alone and have no immediate family or partner, may decide that there is no need for such an investment.

However, most expats do not travel alone. Expats commonly have partners and/or family around. Most expats leave their immediate family behind, when seeking out a new life somewhere else. These people are the reason that you need life insurance as an expat.

Partner and family aside, you will also need to ensure that your financial arrangements are taken care of back home. Having life insurance to cover your remaining assets makes sense. If you have a mortgage, personal loan or any other financial agreement, you need to ensure that this is taken care of. It removes the burden of financial responsibility away from the loved ones that you are leaving behind.

A life insurance policy can also allow you to request what will be paid to your loved ones when you pass away. These requests can save a family from tearing itself apart. One thing that we don’t like to admit is that money and possessions can mean more to some than others. Stipulating where your estate goes when you die can save a lot of heartache and internal wrangling.

Do you need life insurance? Simply ask yourself: do the loved ones in my life need supporting financially when I pass away?

Life Insurance for Expats: Do I Need Health Insurance Too?

In short, yes. You do need health insurance as well as life insurance. The two are very separate policies. However, many people get confused and think health insurance makes up part of your life insurance policy.

The best advice here is to ensure that you have both, especially if you are an expat already or you are planning to become one. There is life insurance policies that have health insurance built in. These life insurance policies do not offer the same comprehensive health insurance benefits as a separate health insurance policy does. Be mindful of these and make sure that you read any policy documentation before you commit to a purchase.

Life Insurance for Expats: Is Life Insurance Expensive?

The age old saying of ‘you pay for what you get’ could not be more apt at answering this question. This doesn’t mean that you have to pay a huge premium to get a life insurance policy that covers you for exactly what you need.

One of the wisest actions to take is to shop around. By using consumer power you have, it is possible to find some great deals on expat life insurance.

Rather than just considering the price, think about what you are leaving at home for your loved ones. What does the life insurance policy need to cover to ensure that any family members aren’t leaving your family in uncertain financial territories?

There is a couple of things that will dictate what you pay for your expat life insurance. Life insurance providers will consider a number of different things. These will include your age and health. For a life insurance provider, it is all about the risk you carry. This will heavily influence the price you pay.

If you are more price conscious than most, you should be able to pick up a very comprehensive life insurance policy for little over 30 pounds per month. It is a small price to pay to give you complete peace of mind.

Life Insurance for Expats: Do I Need To Provide Any Documentation?

Acquiring life insurance or any other insurance for that matter is easy. You will be happy to learn that you do not need to provide much in terms of documentation. Applying for life insurance is just like any other; you complete a form and declare your personal information and some medical history. It is as easy as that.

You may have to supply some supporting documentation. This is especially true if you have a more complex medical history or have moved around quite often.

Life Insurance for Expats: Should I Buy A Life Insurance Policy Online?

This is very much down to personal preference and your current situation. If you are already an expat living abroad, you may be better served by talking to a local independent financial advisor (IFA).

Using an IFA has its advantages, you can sit down and talk to them about your personal situation, your family and your estate. It is during these conversations that using an IFA can be very beneficial. Being able to understand your own needs and requirements gives the IFA the ability to cherry pick the best life insurance policy for you.

If you are soon to become an expat, you can also use an IFA. Some IFAs work on a country by country basis. This can prove troublesome as you will need to find an IFA that can give you the required advice and access to the life insurance policies you need.

Buying online is simple and straightforward. The internet is full of specialist life insurance providers that have immediate access to the life insurance policies you need. One quick internet search and you will find exactly what you are looking for.

Living There

Living There