Going on vacation, locally or abroad, can be the most exciting highlight of your year. But it’s not without its problems and concerns. Chief among these is how you decide to pay for all the services you’ll need from a host of suppliers and merchants: flights, hotel bookings, car hire, tours, restaurant bookings…and any other service you’d like to pay for in advance or online. This will reduce your need to pay in cash and also limit the need to use your credit card in a foreign country. And very often, walking around with large amounts of local currency is not recommended.

The convenience of paying for a wide range of services online is very appealing and, frankly, makes a lot of sense. But there are also obvious concerns about that: many people are still wary – often quite rightly – of giving their credit card and financial details to seemingly faceless websites. Is the hotel you are sending your credit card details to reliable? How secure is their online payment platform? What about that tour operator who was recommended to you by a friend of a friend of a friend? Reliable? Secure? Honest?

You are right to be cautious. However, today mobile payments, digital currencies, pre-paid cards and digital cards provide secure online payment capabilities providing many ways you can book your reservations without having to give away credit card and bank account details.

But there may still be occasions when you have to submit your credit card information for bookings. If so, how can you tell whether the site you are using is secure? Here are a few pointers to help you:

- SSL: To avoid information being sent back and forth between your computer and web servers in “plain text” (making all your details visible to anybody), data can be encrypted before transmission via Secure Sockets Layer (SSL) ensuring a web page is protected. All web pages asking you for sensitive information should be secured using SSL!

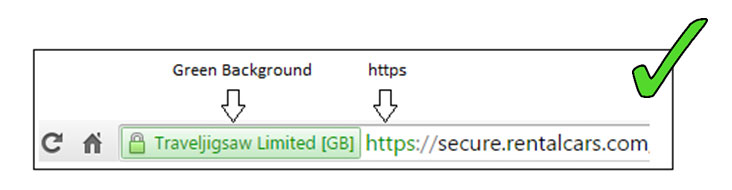

- Color Codes for Certification: Only secure sites with certificates will display green in the address bar; red means the site is not secure and should be treated as suspicious.

- Look for “https” in the web page URL: Normally URLs begin with the letters “http”. However, over a secure connection, the URL should begin with “https” – note the “s” at the end.

- Check for the “Lock” icon: A “lock” icon should be displayed somewhere in the window of the browser (NOT in the web page display area!) Microsoft Internet Explorer displays the lock icon in the lower-right of the browser window, Mozilla’s FireFox Web Browser, in the lower-left corner.

![]() The icon, below, is not a graphic. Click on it, and you will see details of the site’s security. Some fraudulent web sites are designed with an imitation lock icon. If you can’t click it open, it’s probably a suspicious site.

The icon, below, is not a graphic. Click on it, and you will see details of the site’s security. Some fraudulent web sites are designed with an imitation lock icon. If you can’t click it open, it’s probably a suspicious site.

Some additional suggestions include:

Avoid making online purchases in a public place. When using Wi-Fi in public, you cannot guarantee that the network is secure, even if you have been given a password to use.

Avoid making online purchases in a public place. When using Wi-Fi in public, you cannot guarantee that the network is secure, even if you have been given a password to use.- When you make a credit card transaction, you should never be asked for your PIN or online banking password. This is not the same as being asked for the 3 or 4 digit security number (‘CVV2 code’), usually found on the back of your card, which is an additional security feature.

- Address details: The site has a physical address or phone number.

- Privacy statement. Reputable sites will tell you how they protect your personal information and secure your credit card data.

- Keep records: Keep purchase confirmation emails of your online transactions.

For those of you who are still wary about booking with credit cards online, here are some secure payment methods which may not necessarily involve disclosing financial details at all:

Mobile Payments

Customers can use their mobile devices to easily and securely book hotel rooms and other services in any country, whether they have a credit card or not.

Customers can use their mobile devices to easily and securely book hotel rooms and other services in any country, whether they have a credit card or not.

All types of payments are generally possible: credit cards, PayPal, bank transfer, and direct mobile billing, in virtually any currency.

Digital Currencies – Bitcoin

Bitcoin a digital electronic currency, not printed, like dollars or euros, but can be used like conventional currencies. Transactions are secured by military grade cryptography, offering a strong level of protection against many types of fraud.

Bitcoin a digital electronic currency, not printed, like dollars or euros, but can be used like conventional currencies. Transactions are secured by military grade cryptography, offering a strong level of protection against many types of fraud.

Pre-Paid Cards

These may resemble credit cards, but they are loaded with funds by the cardholder in advance and do not provide a line of credit, nor are they linked to any bank account. No banking details are ever disclosed, the customer cannot overspend, and payment is guaranteed.

These may resemble credit cards, but they are loaded with funds by the cardholder in advance and do not provide a line of credit, nor are they linked to any bank account. No banking details are ever disclosed, the customer cannot overspend, and payment is guaranteed.

Payoneer Cards, for example, provide cross-border wire transfers, online payments, and refillable pre-paid debit card services issued through MasterCard, which can be used at ATMs to withdraw cash in local currency, or at the time of purchase.

PayPal

Customers can pay without having to share financial information with the seller. The entire checkout process is handled within a secure online environment. It’s a simple way to pay without sharing your financial information with the seller. PayPal also allows mobile payments via their mobile app.

Customers can pay without having to share financial information with the seller. The entire checkout process is handled within a secure online environment. It’s a simple way to pay without sharing your financial information with the seller. PayPal also allows mobile payments via their mobile app.

All in all, making payments online is easy, fast, efficient…and, if you use the right services and take sensible precautions, totally secure.

You are now prepared with the necessary knowledge to go ahead and book your trip confidently and safely. Enjoy your vacation!

3G Direct Pay Limited

Eran Feinstein is the founder of 3G Direct Pay Limited, a global e-commerce and online payments solutions for the travel and related industries. With over 14 years of leading technology, sales, marketing and operation teams Eran is an authority in the East African e-commerce and payments arena. He’s also an avid marathon runner.

Living There

Living There